Not Dead: There’s Good Reason to Be Long on Bitcoin

With western Christianity set to celebrate the basis of its theology this weekend, bitcoiners the world over might be showing up to churches in droves, hoping one resurrection might lead to another. The ecosystem’s main prophet, Tom Lee of Fundstrat Global Advisors, has outlined four reasons why enthusiasts ought to be bullish on the future: growing trust in digital everything, the awakening millennial boom, crypto recognized as a genuine asset, and Wall Street’s inevitable entry into the space. Also read: Massachusetts Censures Five ICO Crypto Startups in a Single Day

With western Christianity set to celebrate the basis of its theology this weekend, bitcoiners the world over might be showing up to churches in droves, hoping one resurrection might lead to another. The ecosystem’s main prophet, Tom Lee of Fundstrat Global Advisors, has outlined four reasons why enthusiasts ought to be bullish on the future: growing trust in digital everything, the awakening millennial boom, crypto recognized as a genuine asset, and Wall Street’s inevitable entry into the space. Also read: Massachusetts Censures Five ICO Crypto Startups in a Single DayThough it’s Looking Bleak, Tom Lee Believes There’s Good Reason to be Bullish on Bitcoin

Cryptocurrency portfolio holders have not had a great few months. In fact, it has been downright miserable, and appears to be getting worse. Enter Tom Lee, quarter century professional financial veteran, who has been relatively “on” when it comes to generally predicting bitcoin prices. He recently gave a talk about the basis of the crypto economy, and why it matters. First, understand Mr. Lee is a researcher. This means fundamentally he manages no capital, but rather his entire business is based on the trust of his clientele. His are not opinions in the advocacy sense, as he urges everyone listening/reading to come to their own conclusions. He’s merely presenting data and making inferences. He’s no idealogue. He’s not a cypherpunk.

Millenials Are the Largest Single Generation in History

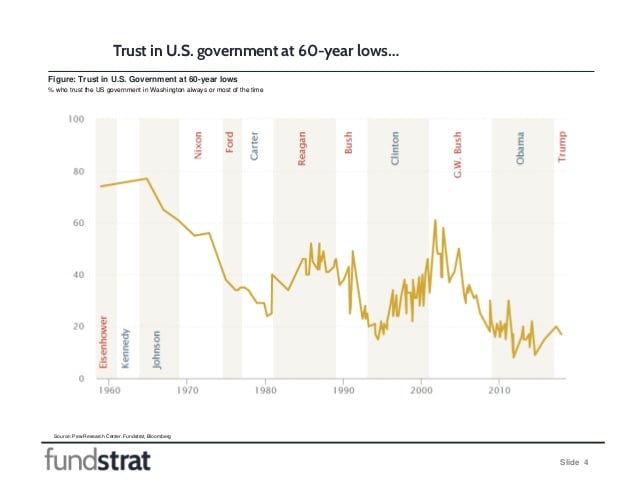

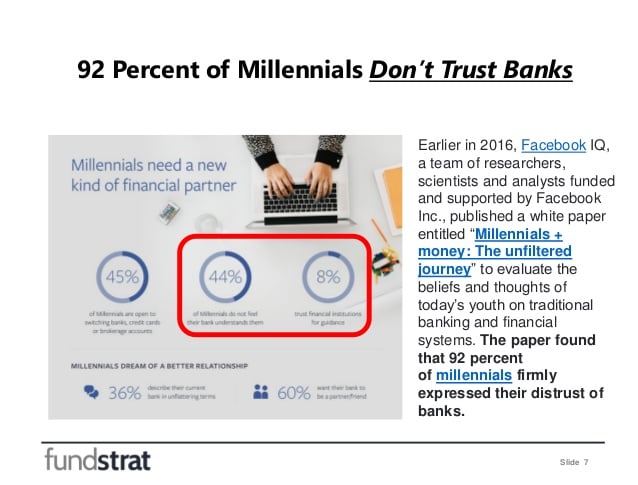

Trust erosion in government-backed banks has infected the present millennial cohort. Having lived through their parents getting rekt in 2008, this group is very distrustful of centralization. According to a 2016 survey, 92% of millennials do not trust banks. Cryptocurrencies like bitcoin are creating what they crave: decentralization, digital scarcity, and native trust – keys to future adoption. Millenials are going to be a giant economic force, especially when one considers they’re roughly 96 million people, the largest generation in human history. In every financial respect, they’re going to move the needle. The average age of this group is 26 years old, and it’s important to learn to understand their thinking. Boomers in their 20s embraced the birth of personal computing (1970s, 80s); Generation Xers in their 20s were around for the internet and ecommerce, Amazon, cellular, text messaging, and Google (1990s, 2000s). Each of those previous cohorts adopted disruptive, misunderstood advances the prior generation couldn’t grasp. Presently, 20 year-olds (2000s-on), have grown up entirely digital: Facebook, Uber, online dating, Instagram, crowdfunding, and, of course, bitcoin. All of these, and more, advances in tech have been resisted by the previous two generations, to greater or lesser degrees. Imagine trying to explain to a person in 1990 there would be a half trillion dollar market cap company that would rely on folks voluntarily sharing their information, and its product would be free. They couldn’t conceive of such a thing. Yet, there Facebook is. The present cohort is primed for decentralized currency, and a good analogy would be to see bitcoin as an emerging market. Generational economic moves tend to last a lot longer than ten years. For example, Boomers’ parents would’ve said the roaring Japanese economy in 1975 was a bubble. It had risen 40 times since 1950, a clearly unprecedented sign of overheating. However, it turns out the emergence of Japan lasted from 1950 through 1990, a forty-year bull run, increasing 400 times. Many Boomers, such as John Templeton of the Templeton Fund fame, didn’t listen to their parents and are thankful they did not. In the next thirty years, millennials are poised to make staggering economic gains. Right now, they’re in their home-buying and investing years. Housing tend to peak with every cohort’s peak size, which would mean housing is likely to boom through 2030 if figures hold, according to Mr. Lee.

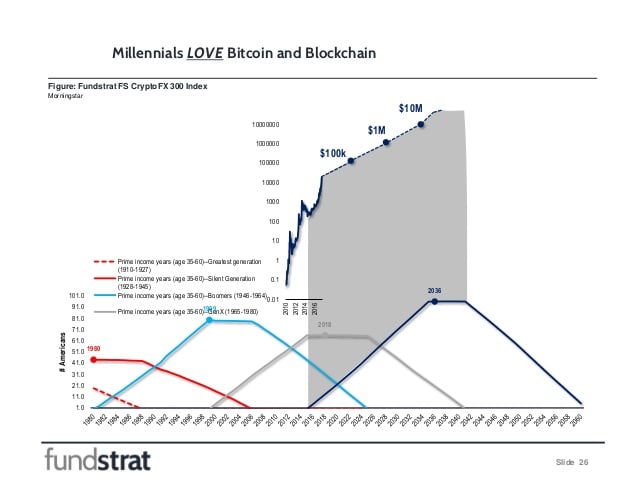

Presently, 20 year-olds (2000s-on), have grown up entirely digital: Facebook, Uber, online dating, Instagram, crowdfunding, and, of course, bitcoin. All of these, and more, advances in tech have been resisted by the previous two generations, to greater or lesser degrees. Imagine trying to explain to a person in 1990 there would be a half trillion dollar market cap company that would rely on folks voluntarily sharing their information, and its product would be free. They couldn’t conceive of such a thing. Yet, there Facebook is. The present cohort is primed for decentralized currency, and a good analogy would be to see bitcoin as an emerging market. Generational economic moves tend to last a lot longer than ten years. For example, Boomers’ parents would’ve said the roaring Japanese economy in 1975 was a bubble. It had risen 40 times since 1950, a clearly unprecedented sign of overheating. However, it turns out the emergence of Japan lasted from 1950 through 1990, a forty-year bull run, increasing 400 times. Many Boomers, such as John Templeton of the Templeton Fund fame, didn’t listen to their parents and are thankful they did not. In the next thirty years, millennials are poised to make staggering economic gains. Right now, they’re in their home-buying and investing years. Housing tend to peak with every cohort’s peak size, which would mean housing is likely to boom through 2030 if figures hold, according to Mr. Lee.  Every year, there’s roughly a trillion dollars people ages 35 through 60 allocate for investment. Today, it’s dominated by Boomers and Gen X. Millennials are just now entering those prime income years. The Silent Generation, the cohort before the Boomers, bought gold during their prime years, and drove the price from 40 USD to over 600 USD in just ten years. Boomers turned 35 years old in 1982, and from 1982 to 1989 there was a stock market boom as they purchased equities like never before. Gen X, a much smaller cohort, didn’t move the numbers quite as much. Millenials are more like the previous generations prior to Gen X. If the trend continues, millennials will soon have a trillion dollars in savings flow. Bitcoin’s rise around 2016 coincides with the first millennials entering their prime savings years. And for every set of one billion dollars thrown at crypto, it translates into 25 billion in price appreciation, according to Mr. Lee. Millennials could very well place ten percent of their trillion dollars, 100 billion, into crypto, translating into a two and a half trillion rise per year. Mr. Lee surmises at the end of the millennial cycle, bitcoin’s price could be as high as 10 billion USD.

Every year, there’s roughly a trillion dollars people ages 35 through 60 allocate for investment. Today, it’s dominated by Boomers and Gen X. Millennials are just now entering those prime income years. The Silent Generation, the cohort before the Boomers, bought gold during their prime years, and drove the price from 40 USD to over 600 USD in just ten years. Boomers turned 35 years old in 1982, and from 1982 to 1989 there was a stock market boom as they purchased equities like never before. Gen X, a much smaller cohort, didn’t move the numbers quite as much. Millenials are more like the previous generations prior to Gen X. If the trend continues, millennials will soon have a trillion dollars in savings flow. Bitcoin’s rise around 2016 coincides with the first millennials entering their prime savings years. And for every set of one billion dollars thrown at crypto, it translates into 25 billion in price appreciation, according to Mr. Lee. Millennials could very well place ten percent of their trillion dollars, 100 billion, into crypto, translating into a two and a half trillion rise per year. Mr. Lee surmises at the end of the millennial cycle, bitcoin’s price could be as high as 10 billion USD.

Digital Asset

The St. Louis Federal Reserve branch recently released a paper agreeing crypto is a new asset class, a digital asset. With evolving financial strategies and realities (only 20% of all public tech companies actually earn a profit, for example), and a supermajority of the S&P’s value being “intangible,” value today is largely built on trust, a subject to which we return. Where people tend to trust their money to grow in value is in the 280 trillion dollar collectables market: gold, art, real estate, government bonds, cars, etcetera. Bitcoin averages around a 200 billion dollar market cap, and if bitcoin captures just 1 percent of that market it would translate into 150,000 USD per coin, Mr. Lee stresses.Wall Street

Another reason to be optimistic about bitcoin’s future is the prospect of Wall Street entering. Presently the largest exchange today is ICE, and its revenue is right around 4.6 billion USD. Crypto exchange Coinbase, by contrast, has only four currencies on it, and accounts for a mere 3 percent of trading volume. It will make about 600 million this year, Mr. Lee is estimating. It’s not too far-fetched to think in as little as, say, 18 months Coinbase could overtake ICE as the most profitable exchange in the world. Indeed, legacy firms like Goldman and Morgan Stanley are building gateways into crypto in anticipation. The crypto market cap is already larger than most countries of the world, and has regularly ranked in the top 20, at times bigger than Ireland, Spain, Greece. Wall Street has been heavily invested in such countries, and to think it would avoid crypto entirely is probably not financially rational. It won’t. There’s money to be made.

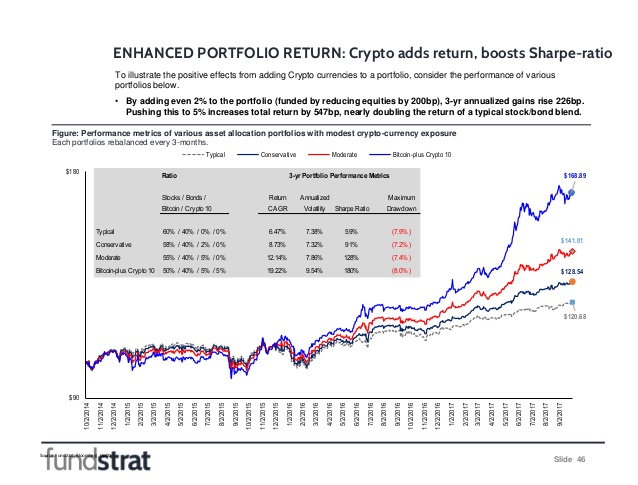

The crypto market cap is already larger than most countries of the world, and has regularly ranked in the top 20, at times bigger than Ireland, Spain, Greece. Wall Street has been heavily invested in such countries, and to think it would avoid crypto entirely is probably not financially rational. It won’t. There’s money to be made. Lastly, bitcoin and crypto remain largely uncorrelated to other markets, a coveted spot in traditional portfolios known as uncorrelated alpha. Mr. Lee suggests that firms won’t have to dive-in entirely to crypto, and would see a nice rise in gains, less portfolio volatility, if they owned as little as 2 percent. That’s a risk he’s betting Wall Street is going to make.

What are your predictions for bitcoin/crypto? Let us know in the comments!

Images via Pixabay, Fundstrat, CNBC.

At news.Bitcoin.com we do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published. The post Not Dead: There’s Good Reason to Be Long on Bitcoin appeared first on Bitcoin News.

Amazon Argentina bonds Boomers Brazil Decentralization Digital Scarcity Facebook Featured Fundstrat Gen x Google government trust Greece housing starts Instagram Ireland Japan John Templeton Millennials N-Featured prediction Price S&P 500 Silent Generation St Louis Fed Templeton Fund Tom Lee Uber uncorrelated alpha United States Wall Street