Dancing With the Devil: ‘Cashing Out’ Cryptos Into Fiat Not So Easy

Bitcoin and other cryptocurrency assets are precious and some of them have grown over 1300 percent in value this year. Although, with the price on exchanges being higher than ever before its now a bit more difficult for those who want to ‘cash out’ or make significantly large purchases without being watched by the prying eyes of tax collectors and governments. Also read: Russian Regulators Draft Law to Restrict Crypto Mining, Payments, and Token Sales

Bitcoin and other cryptocurrency assets are precious and some of them have grown over 1300 percent in value this year. Although, with the price on exchanges being higher than ever before its now a bit more difficult for those who want to ‘cash out’ or make significantly large purchases without being watched by the prying eyes of tax collectors and governments. Also read: Russian Regulators Draft Law to Restrict Crypto Mining, Payments, and Token SalesBuying That Lambo May Not Be So Easy

Lately across social media and forums, you can find posts written by individuals who have ‘cashed out.’ Maybe they bought a luxury car like a Lambo, paid off their mortgage, or cleared their student loans with cryptocurrency gains. However some of conversations online concerning how to cash out detail how difficult it is without being watched, or being stopped by the third party payment processors.

Two-Way Bitcoin ATMs and Taking It to the Streets With Localbitcoins

Then maybe you say to yourself, “well I could sell my funds to a two-way BTM.” Well, most of the two-way bitcoin automated teller machines only allow users to sell $200-500 per day. At that rate to cash out $10,000 worth of bitcoin, you would have to visit the BTM for twenty days straight and pay a 7-10 percent fee as well. Another talking point that always enters the conversation is those who believe it’s simple to use Localbitcoins to cash their BTC into fiat. In some areas of the world it’s easy to do this, but in countries like the U.S., they are arresting large Localbitcoins sellers for illegal money transmission and other charges.

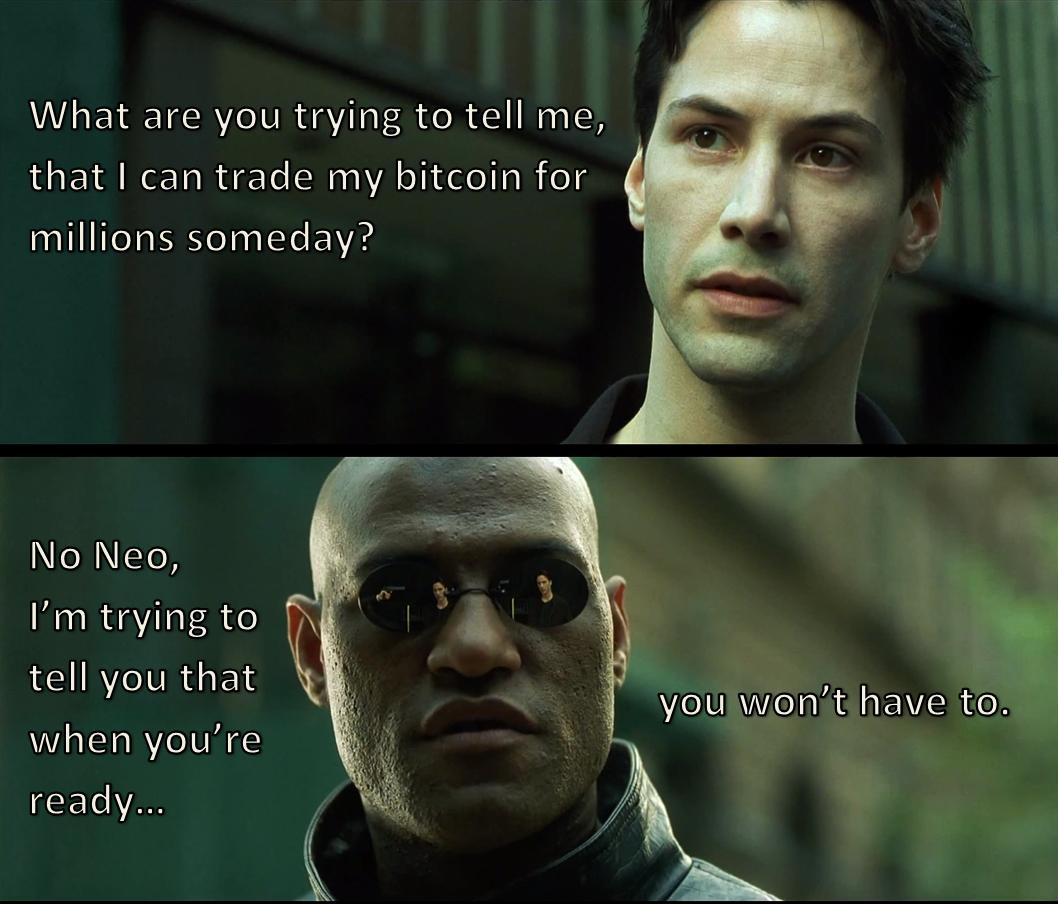

‘Someday Neo, You Won’t Have To’

It’s true many cryptocurrency enthusiasts have been able to cash out using the methods mentioned above, but there are always risks involved with converting back to fiat. Some people don’t care as they’ve done nothing ‘wrong’ and have no problem shelling out 33 percent for capital gains or other taxes involved. Also, there are many different ways people have found to be a reliable way to sell large amounts of cryptocurrencies as well. This includes people who know someone at an exchange, someone who is friendly with a miner or big over-the-counter (OTC) dealers.

Images via Shutterstock, the Matrix, and Pixabay.

Make your voice heard at vote.Bitcoin.com. Voting requires proof of bitcoin holdings via cryptographic signature. Signed votes cannot be forged, and are fully auditable by all users. The post Dancing With the Devil: ‘Cashing Out’ Cryptos Into Fiat Not So Easy appeared first on Bitcoin News.

BTC Cryptocurrencies Digital Assets Economy & Regulation Fiat Middle Men Money Laundering money transmission N-Economy Nation State Issued Currencies Regulation tax evasion Third Party Virtual Currencies